- Hello Customer - Log in or Register!

OXFORD, Conn.--(BUSINESS WIRE)--Feb. 8, 2017-- RBC Bearings Incorporated (Nasdaq: ROLL), a leading international manufacturer of highly-engineered precision bearings and components for the industrial, defense and aerospace industries, today reported results for the third quarter of fiscal year 2017.

“We were able to drive solid financial performance in what is traditionally our slowest seasonal fiscal quarter,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “Our restructuring activities are driven by a strategy to achieve better alignment and rationalization of our manufacturing resources to more efficiently support a period of increasing industrial demand.”

Third Quarter Results

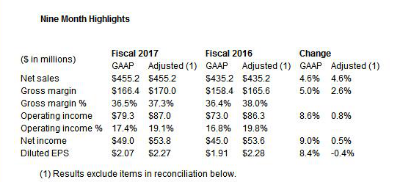

Net sales for the third quarter of fiscal 2017 were $146.7 million, an increase of 1.7% from $144.2 million in the third quarter of fiscal 2016. Net sales for the aerospace markets increased 1.2% and the industrial markets increased 2.7%. Gross margin for the third quarter of fiscal 2017 was $52.4 million compared to $53.5 million for the same period last year. Excluding the impact of integration and restructuring and an inventory purchase accounting adjustment last year, gross margin would have been $55.6 million compared to $54.1 million for the same period last year. Adjusted gross margin as a percentage of net sales would have been 37.9% in the third quarter of fiscal 2017 compared to 37.5% for the same adjusted period last year.

SG&A for the third quarter of fiscal 2017 was $25.7 million, an increase of $1.8 million from $23.9 million for the same period last year. The increase of $1.8 million was mainly due to $0.9 million in personnel related costs, $0.4 million incentive stock compensation, $0.2 million in professional fees, and $0.3 million of other items. As a percentage of net sales, SG&A was 17.5% for the third quarter of fiscal 2017 compared to 16.5% for the same period last year.

Other operating expenses for the third quarter of fiscal 2017 totaled $6.1 million, an increase of $3.5 million, compared to $2.6 million for the same period last year. For the third quarter of fiscal 2017, other operating expenses were comprised mainly of $3.8 million of integration and restructuring costs and $2.3 million of amortization of intangible assets. Other operating expenses last year consisted primarily of $2.5 million in amortization of intangibles and $0.1 million of other items.

Operating income for the third quarter of fiscal 2017 was $20.5 million compared to operating income of $27.1 million for the same period last year. Excluding costs associated with integration and restructuring, operating income would have been $27.6 million for the third quarter of fiscal 2017 compared to an adjusted $27.6 million for the same period last year. Excluding these adjustments, operating income as a percentage of net sales would have been 18.8% compared to 19.2% for the same period last year.

Interest expense, net was $2.1 million for the third quarter of fiscal 2017 compared to $2.2 million for the same period last year.

Income tax expense for the third quarter of fiscal 2017 was $5.9 million compared to $7.8 million for the same period last year. Our effective income tax rate for the third quarter of fiscal 2017 was 31.5% compared to 31.5% for the same period last year. The effective income tax rate without discrete tax benefit items would have been 31.8% and 32.1%, respectively.

Net income for the third quarter of fiscal 2017 was $12.8 million compared to $17.0 million for the same period last year. On an adjusted basis, net income would have been $17.4 million for the third quarter of fiscal 2017, compared to an adjusted net income of $17.3 million for the same period last year.

Diluted EPS for the third quarter of fiscal 2017 was 54 cents per share compared to 73 cents per share for the same period last year. On an adjusted basis, diluted EPS for the third quarter of fiscal 2017 would have been 73 cents per share compared to an adjusted diluted EPS of 73 cents per share for the same period last year.

Backlog, as of December 31, 2016, was $349.1 million compared to $351.3 million as of December 26, 2015.

Integration and Restructuring of Industrial Operations

In the third quarter of fiscal 2017, the Company reached a decision to integrate and restructure its industrial manufacturing operation in South Carolina. The Company will exit a few smaller product offerings and consolidate two manufacturing facilities into one. These restructuring efforts will better align our manufacturing capacity and market focus. As a result the Company recorded a charge of $7.1 million associated with the integration and restructuring activity attributable to the Roller Bearings segment. The $7.1 million charge includes $3.2 million of inventory rationalization costs, $2.4 million loss on fixed asset disposals, $1.2 million exit obligation associated with a building operating lease, and $0.3 million impairment of intangible assets. The inventory rationalization costs were recorded in “Cost of Sales” and all other costs were recorded in “Other, net” in the income statement.

| Product Model | Inside Diameter | Outside Diameter | Thickness |

| FCD3042210 bearing | 250 | 350 | 220 |

| FCD3042211 bearing | 250 | 350 | 220 |